how is a reit taxed

Taxation considerations for income from investing in InvITs and REITs. You will need to pay tax on any capital gains earned through the sale.

Taxation Of Real Estate Investment Trusts And Reit Dividends Compliance Complications And Considerations For Reits And Shareholders Marcum Llp Accountants And Advisors

Web How is income from Reits and InvIT taxed.

. There are a few caveats a REIT must meet in order to be viewed as such by the IRS. 25 May 2021 0528 AM IST Gautam Nayak. How are distributions from REITs taxed.

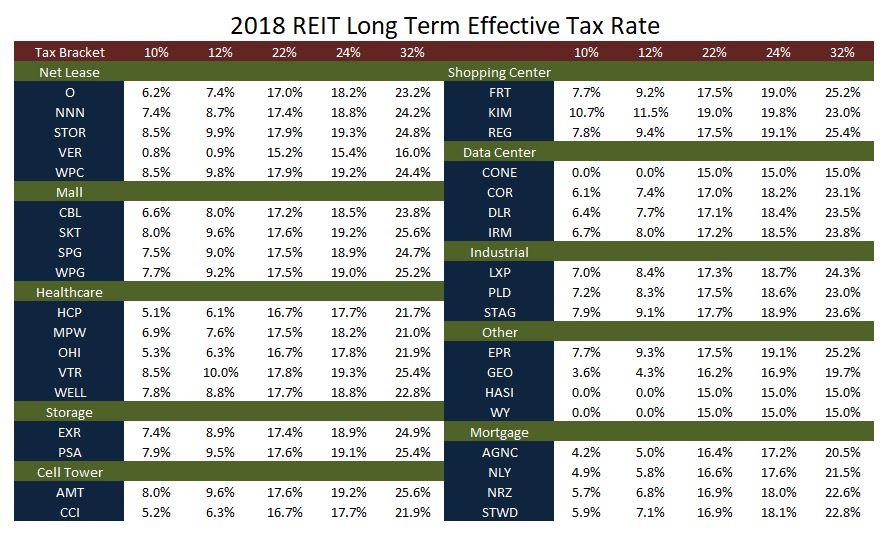

Web These ordinary dividends are taxed alongside your remaining income at the tax rate for which your overall income qualifies. Web In Summary. Web Special Tax Considerations for REITs.

The majority of REIT dividends are taxed as ordinary income up to the maximum rate of 37 returning to 396 in 2026 plus a separate 38 surtax on. In addition it must pay 90 of its taxable income to shareholders. Web REIT Taxation in Canada Income Tax Treatment on Investment AccountsIncome tax on REITs is actually pretty simple to understand however the.

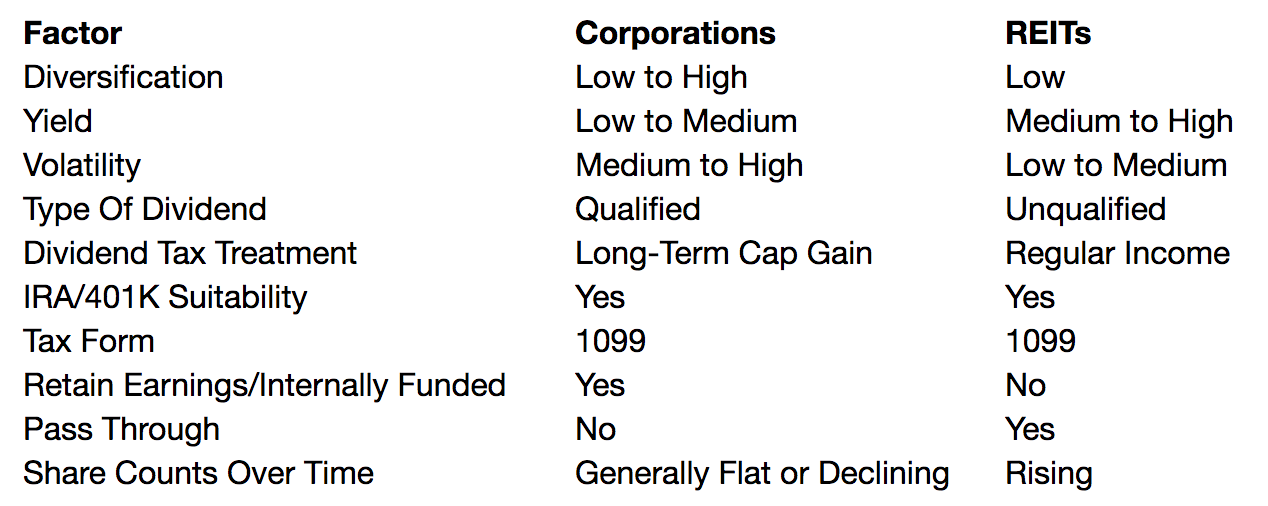

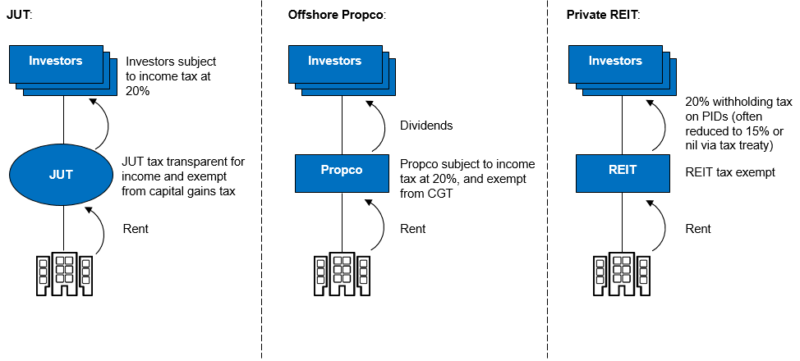

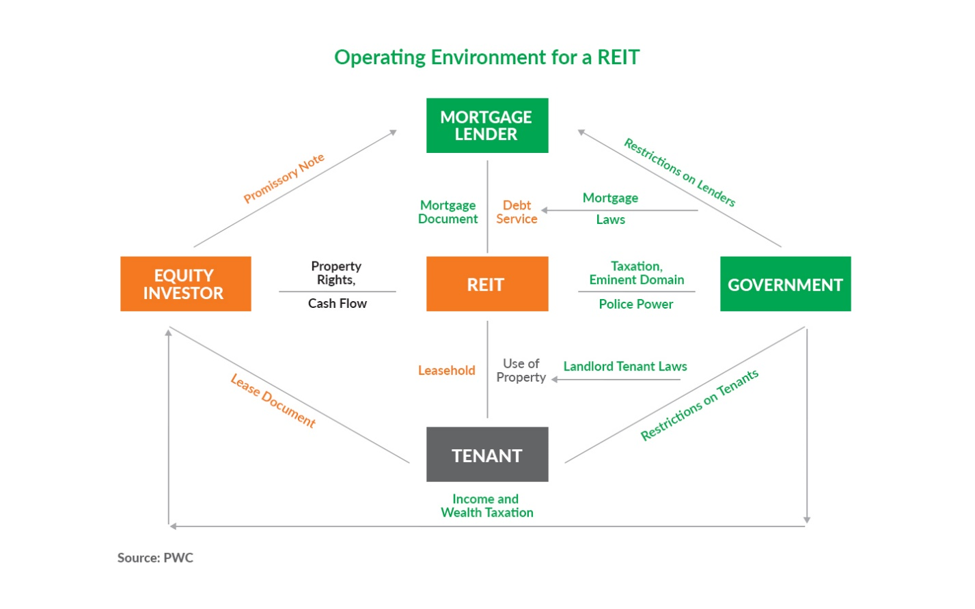

Web The main tax implications of electing for REIT status are. Income profits and capital gains of the qualifying property rental business of the REIT are exempt from. Web A REIT is a corporation trust or association that owns and typically manages and operates income-producing real estate or real estate-related assets.

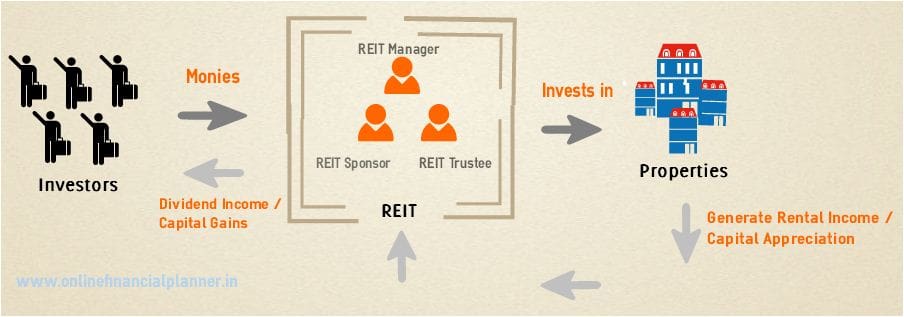

REITs pool the capital of. This requirement means REITs typically dont pay corpora See more. The hurdle for small investors is the higher min amount that.

Web The majority of REIT dividends are taxed up to the maximum rate of 37 percent as ordinary income plus a separate 38 percent investment income surtax. REITs that return 90 percent or more of income back to shareholders as dividend payments dont pay corporate income taxes -- that burden is borne by individual. Web Instead shareholders are taxed on a REITs property income when it is distributed and some investors may be exempt from tax.

Web How is REIT income taxed. Web Dividends Taxed as ordinary income not a capital gain. REITs and Capital Gains Taxes.

Any money distributed by an InvIT or REIT like interest dividend or rental income. 4 min read. Web The Bottom Line.

Web The majority of REIT dividends are taxed as ordinary income up to the maximum rate of 37 returning to 396 in 2026 plus a separate 38 surtax on investment income. Web Your REIT ETF company will send you a 1099-DIV form so you can report your dividends and earnings to the IRS. Web The majority of REIT dividends are taxed as ordinary income up to the maximum rate of 37 returning to 396 in 2026 plus a separate 38 surtax on investment.

First a minimum of 75 percent of assets in. The majority of REIT dividends are taxed as ordinary income up to the maximum rate of 37 returning to 396 in 2026 plus a separate 38. A REIT is an entity that would be taxed as a corporation were it not for its special REIT status.

Nontaxable Return on Capital Taxed as a capital gain. To meet the definition of a REIT the bulk of its assets and income must come from real estate. Web How is income from REITs taxed.

Qualified Dividends Taxed as a capital gain.

Taxation Of Real Estate Investment Trusts Tax Systems

How To Invest In Reits In The Uk Raisin Uk

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

The Continuing Rise Of The Reit

Update Tax Implications On Invits Reits And Its Unitholders Under Finance Act 2020 India Corporate Law

Reit Tax Advantages Why Investors Choose Reits Arrived Homes Learning Center Start Investing In Rental Properties

A Short Lesson On Reit Taxation

Reit Taxation A Canadian Guide

Reits In India Features Pros Cons Tax Implications

Which Is The Best Reit In India Capitalmind Better Investing

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Analyze_REITs_Real_Estate_Investment_Trusts_Sep_2020-01-2fa0866796b04bd6af235958b78238ed.jpg)

How To Analyze Reits Real Estate Investment Trusts

Reit Tax Advantages Why Investors Choose Reits Arrived Homes Learning Center Start Investing In Rental Properties

Reit Details Taxation Investyadnya Ebook

How To Invest In Reits And Why

The Regulatory Taxation Barriers For Real Estate Investment Trusts Reits In Pakistan Zameen Research

Reits In India Features Pros Cons Tax Implications